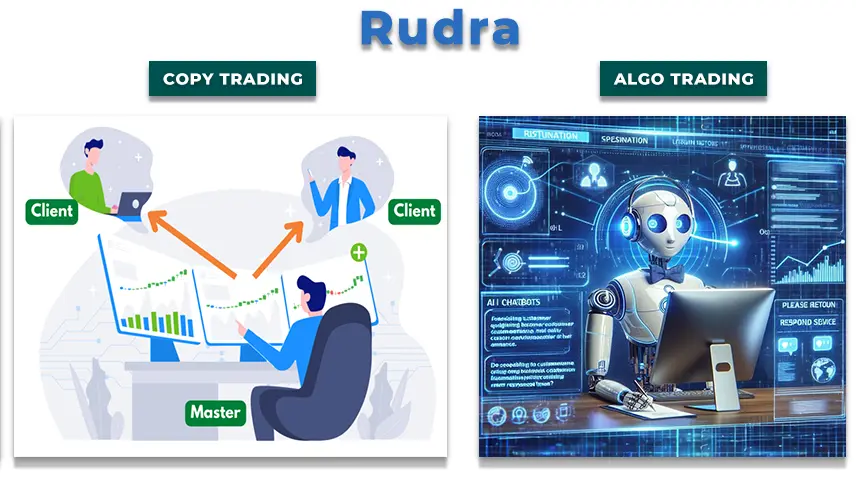

Copy trading and Algo trading in Rudra

Algorithmic buying and selling, or a set of rules buying, leverages algorithms to carry out trades according to predetermined parameters and strategies approximately profits for getting and selling execution conveniently and improves capability pass decrease returned can. Rudre replica buying and selling, then again, offers investors a hands-on view of marketplace percentage.

How does copy trading work?

A mechanism referred to as "Copy buying and selling" permits buyers to replicate trades with the help of informed and profitable purchasers.

How to copy trade in Rudra?

- Registration and Login: Create an account with Rudra Business Platform and log in with your credentials.

- Find traders: Go to the copy trading section, where you can find and evaluate experienced traders based on their performance metrics, trading strategies, and risk profiles.

- Choose a broker: Choose a broker to follow that matches your investment goals and risk tolerance.

- Allocate Cash: Decide how much capital you want to allocate for sales simulation and customize. They use this money to showcase their work accordingly.

- Start matching: Once you have allocated your funds, the platform will repeat the selected trader’s trade in your account.

- Monitoring Performance: Regularly monitor the performance of your copy marketing investments and adjust your strategy or marketing options as needed.

Learn Simple copy Trading Strategies for Rudra in points:

- Research Traders: Examine the performance history, risk levels, and shopping for and promoting strategies of different investors in Rudra and choose the only that suits your investment targets.

- Diversify: Spread your investments through a couple of traders to lessen the chance and boost the possibilities of a higher normal return.

- Set funding limits: Define clear capital limits for each supplier to manage the dangers you face.

- Review often: Periodically evaluate the general performance of the customers you're sampling and modify your preference as necessary based totally mostly on their ordinary performance and adjustments in marketplace conditions.

- Pursue performance: Focus on constantly efficient and occasional-hazard traders in preference to investors who make occasional profits.

- Keep informed: Be aware of market tendencies and factors that can affect the performance of the buyers you observe and be organized to adjust them as essential.

- Understand the approaches: Your income artist desires to have essential statistics of the techniques in case you want to better align with their style and meet expectations.

What is Algo trading?

Trading in computer algorithms is known as algorithmic trading or buying and selling Algos, based primarily on pre-defined requirements. These algorithms make business decisions and execute orders quickly and efficiently by analyzing statistical data and mathematical models.

How to algo trade in Rudra?

- Set Up Account: Create an account with Rudra Business Platform and perform the required verification steps.

- How to use algorithmic trading tools: Go to the algorithmic trading section of the platform, which can be found listed under advanced trading techniques or tools.

- Choose or create an algorithm: Choose from pre-built buying and selling algorithms available in Rudra, or, if supported, create your own custom algorithm based on a buying and selling strategy based on your needs.

- Configure parameters: Set parameters for your rules, including risk limits on sales, buy and sell signals, and discharge limits. This will teach buyers and sellers how to communicate using computers and algorithms.

- Go back and try the guidelines: Use the calculations, analyze the overall performance of your algorithm in previous runs, and adjust its settings as necessary to get the best results

- Use some guidelines: Be satisfied with the results of the background check, follow the list of guidelines, and start buying and selling. Monitor its activity in real-time to ensure it is working as expected.

- Evaluate: The overall effectiveness of the code and make necessary changes to standards or procedures in response to changing market conditions and your advertising and marketing objectives.

- Stay informed: stay current with changes in platform developments in the market, as well as developments that can enhance your algorithm.

Contact Us for Inquiries

Register for call back

Learn Simple algo Trading Strategies for Rudra in points:

- Moving Average Crossover: A trade based on a crossover of short-term and long-term moving averages.

- Trend Following: Follow and trade in line with the prevailing market trend.

- Medium Reversion: Buy when prices fall significantly below the threshold and sell when they rise above them.

- Momentum trading: Trading based on momentum indicators such as RSI or MACD that show strong trends.

- Statistical arbitrage: Exploit price inefficiencies between related assets.

- Breakout Trading: Enter a trade when prices break major support or resistance levels.

- Volume-based trading: Trading based on large changes in trading volume.

- Report-Based Trading: Make trades based on the impact of news and economic events.

Copy Trading Benefits:

- Accessibility: Enables beginners to emulate experienced traders and invest with minimal knowledge.

- Simple: Eliminates the need for in-depth market research and planning.

- Diversification: Enables diversification by having multiple traders with different tracking strategies.

- Time savings: Reduces time and effort required for active trading and market monitoring.

- Transparency: Provides visibility into the operations and strategies of imitative traders.

Algorithmic trading benefits:

- Speed: Extremely hurries up trades, taking benefit of fleeting market opportunities.

- Accurate: Reduces human errors and emotional decision-making via constructing hit trades primarily based on regulations.

- Return the preferred: It can be finished to assess effectiveness before executing stay transactions through techniques for checking out for historical facts.

- Efficiency: Perform greater obligations concerning analyzing data without the want for human intervention.

- Consistency: Avoids emotional biases and supports conventional company methods and regions.

Check out the pricing details

Price

AI BOT Features:

- AI BOT-Algo Trading and Copy Trading is a web-based platform.

- AI BOT supports multiple brokers.

- AI BOT allows cross-broker copy-trading.

- AI BOT supports algo trading from various trading platforms eg. Trading View, MT4/5, Python, Excel, Amibroker, Ninja Trader, etc.

- AI BOT supports direct trading in multiple accounts in one click.

- AI BOT has basket order and one-click trade features.

- AI BOT can place a trade in thousands of accounts in one click with mili-seconds latency.

- AI BOT your trades can copied even when you are not suitable for part-time traders as well.

To view price details for copy trading

Conclusion:

Rudre replica buying and selling is a perfect choice for folks who perform their own manual since it makes it easy for beginners to invest in informed trading glasses. A more fashionable, statistics-pushed approach of consuming change primarily based on predetermined parameters and optimizing procedures through speed and accuracy is supplied through algorithmic buying and selling. Technical benefits. The algo function emphasizes overall performance and consistency, though the replica feature concentrates on readability of use

Read more: